VIP Support & Resistance Matrix™

Find Powerful Trading Levels That Expert Traders Use with Support & Resistance Matrix™ – Your Key to Successful Trading

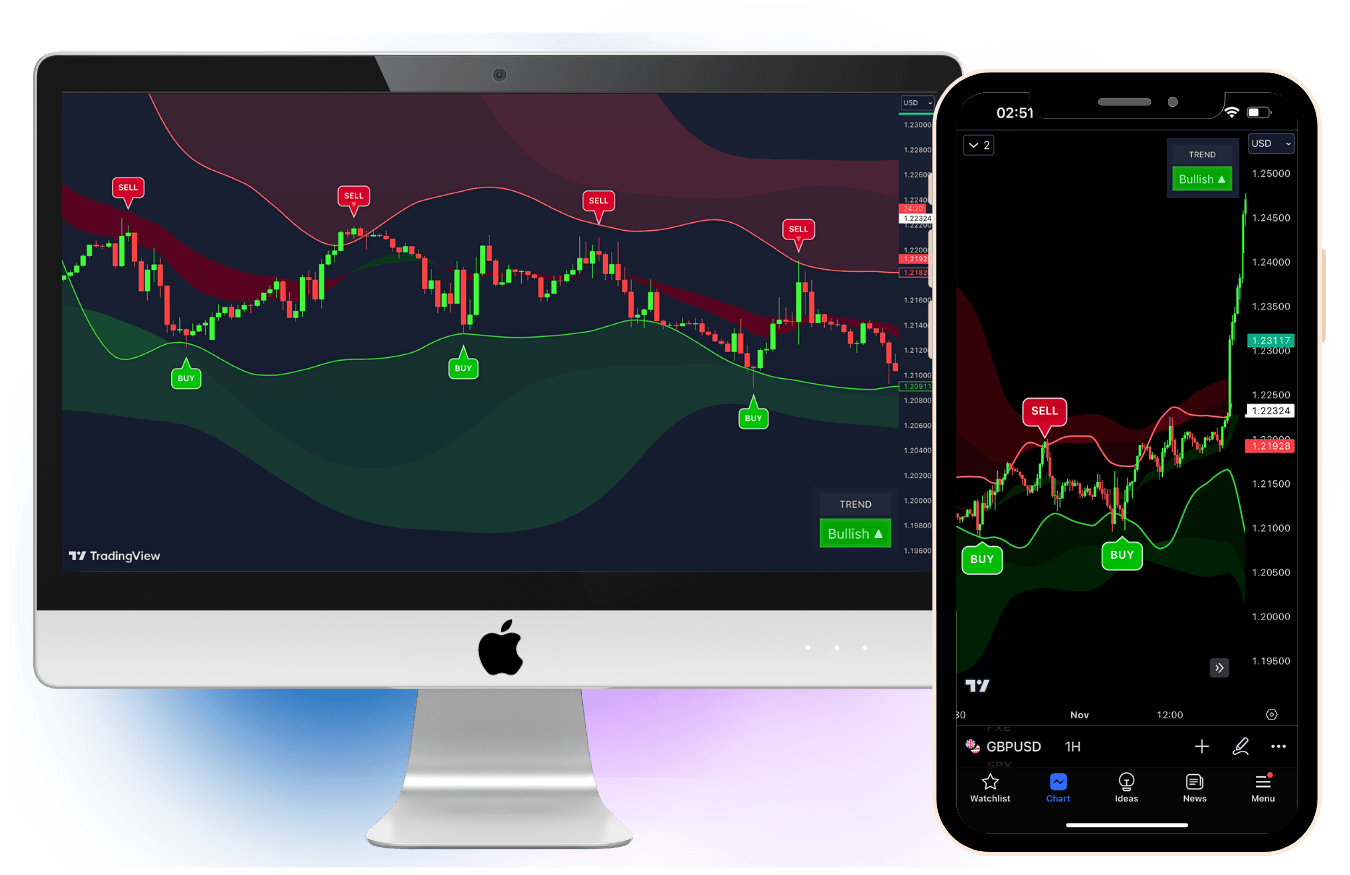

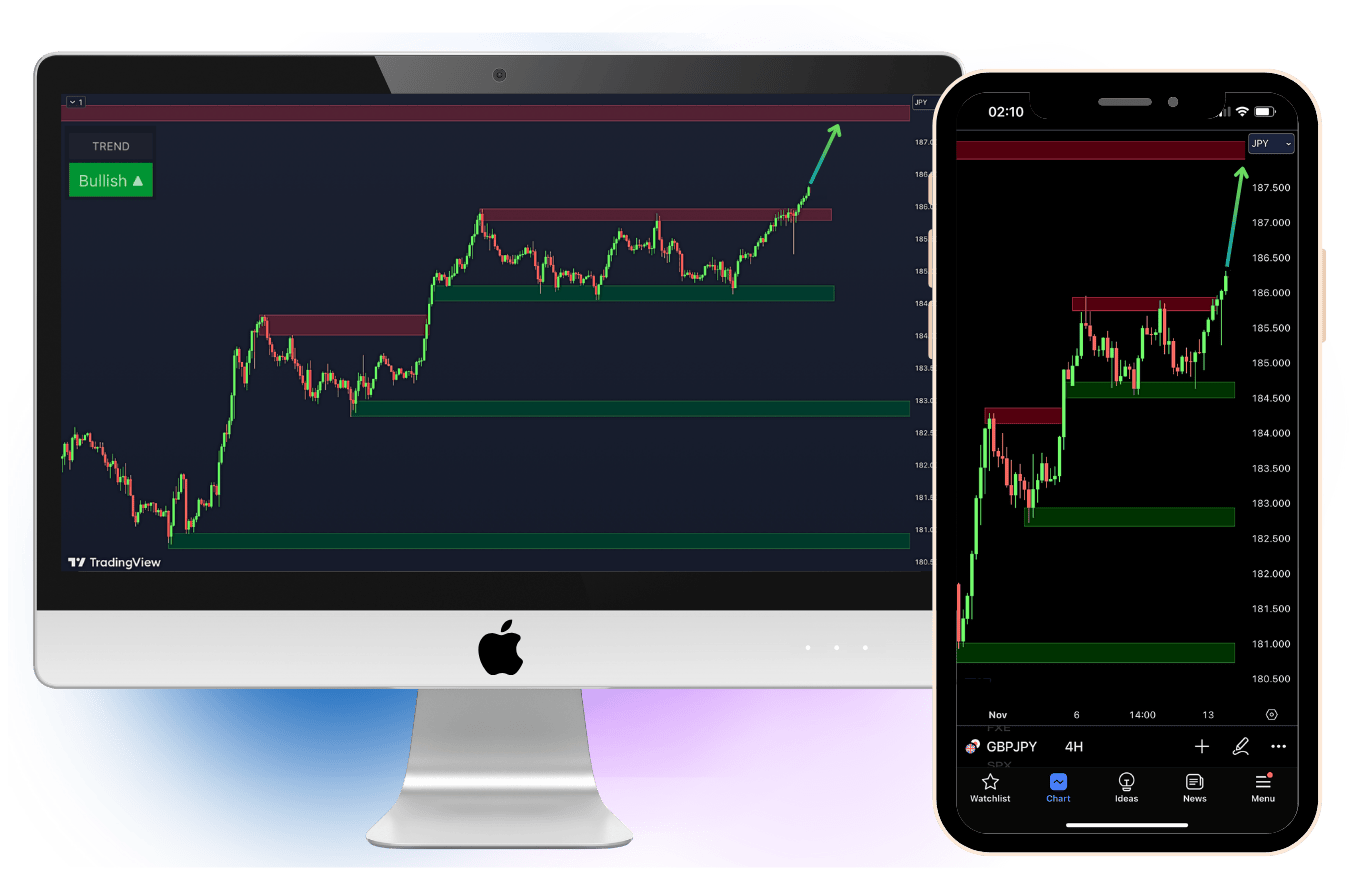

Navigate the Markets like a Professional trader: Introducing the Support and Resistance Matrix™. This essential tool is a game-changer in trading, providing you with a critical edge. Each market movement opens a door to profit, and with this tool, you’re always ready to step through. More than an indicator, it’s a revolutionary approach to understanding market structure, elevating your trading to new heights of success.

Experience the power of trading with this tool. The Support and Resistance Matrix™ is your key to uncovering the market's hidden levels. With its easy to use interface and powerful ability to identify significant support and resistance points, this tool is a must have for growing your trading account. It works around 24/hrs, providing you with clear markers of where to enter and exit trades, every day, every hour.

This remarkable tool is constantly working to bring you the most reliable trading insights. Whether you're looking for short-term gains or long-term strategies, it’s designed for all types of traders. Simplicity is at its core, making it the perfect companion even for those new to the trading world. The Support and Resistance Matrix™ isn’t just an aid; it’s your guide to navigating the trading landscape with confidence and precision.

Introducing The Support & Resistance Matrix:

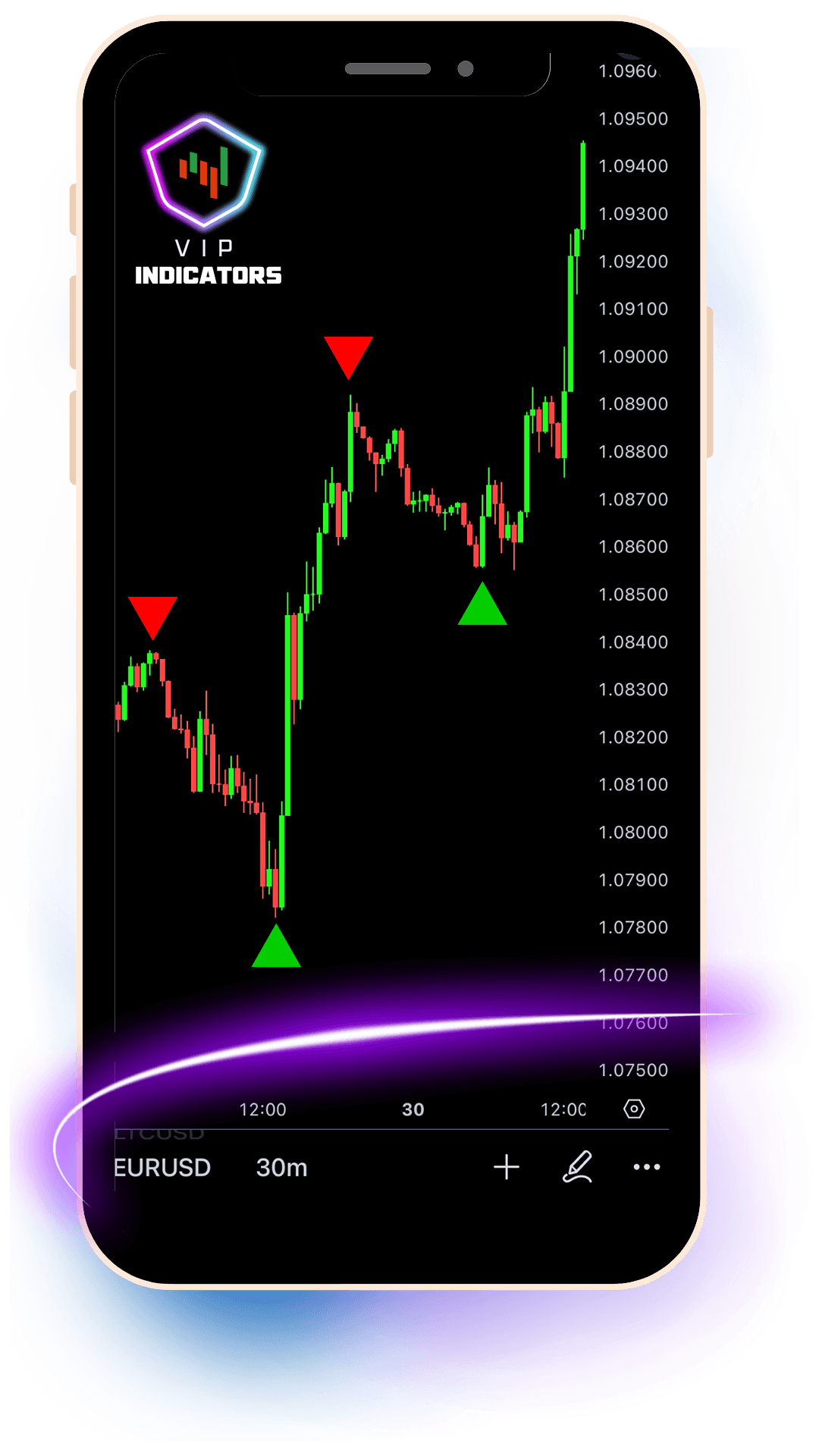

Watch The Support & Resistance Matrix In Action:

Key Benefits Of The VIP Support & Resistance Matrix™

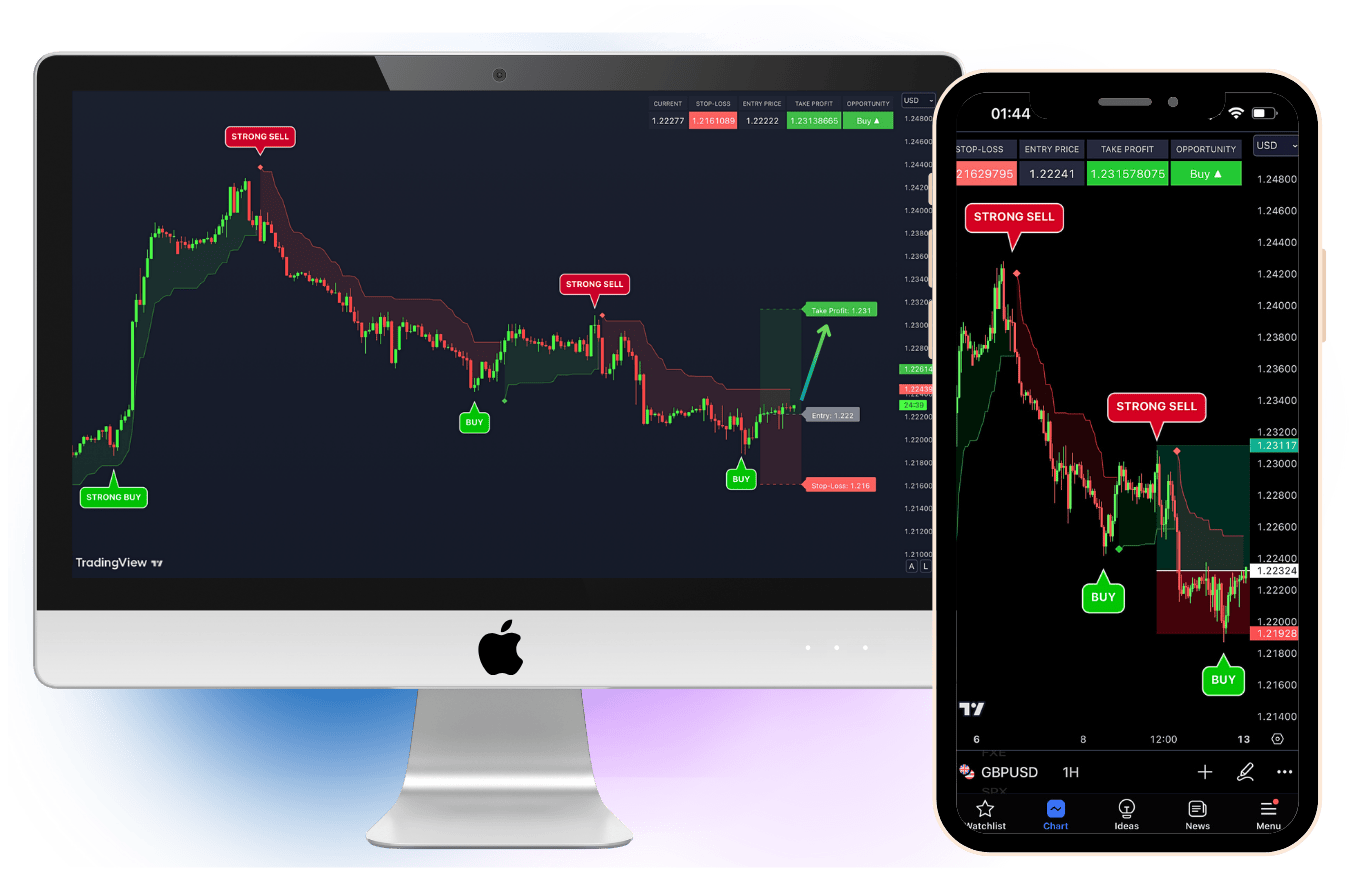

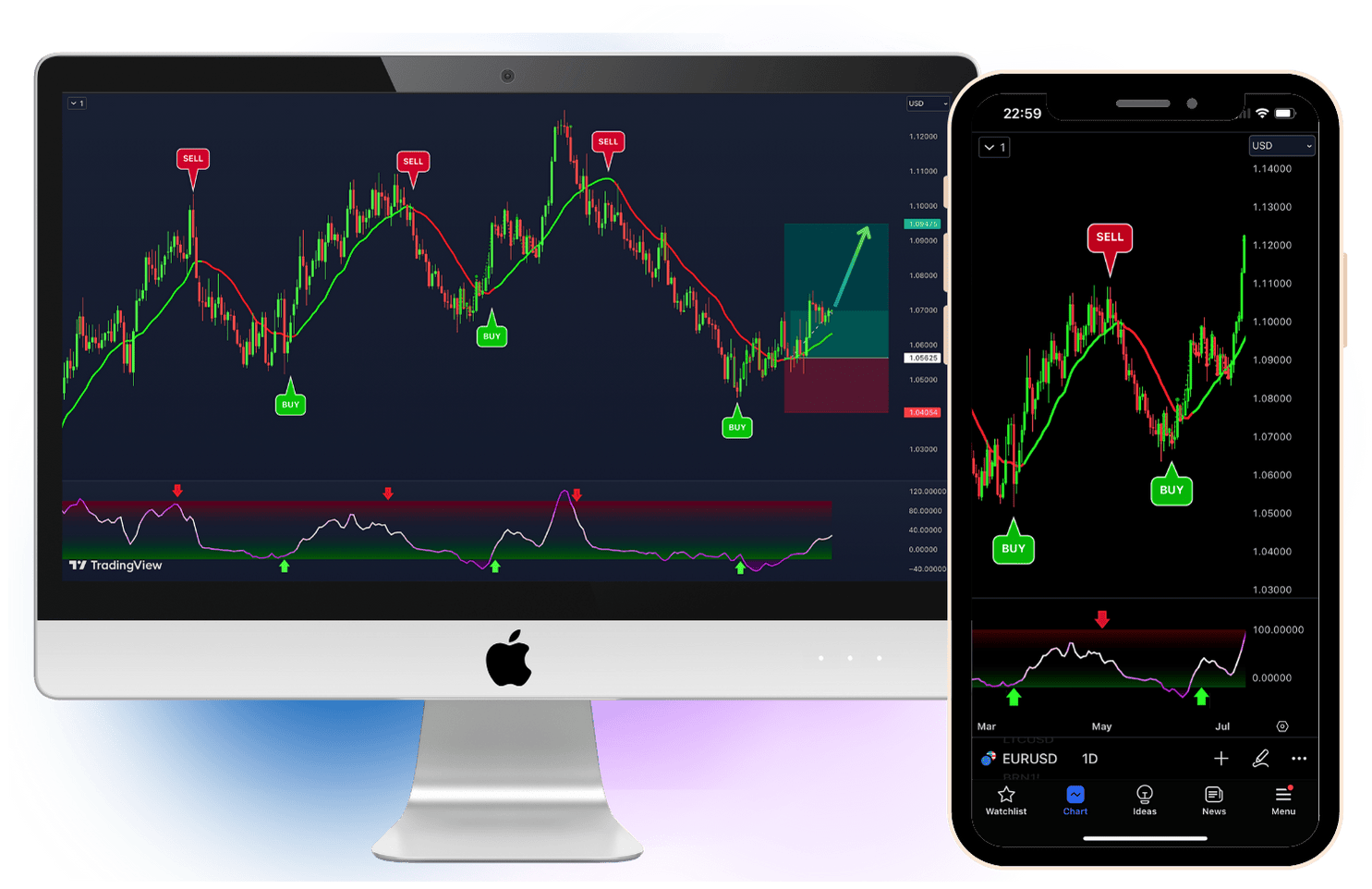

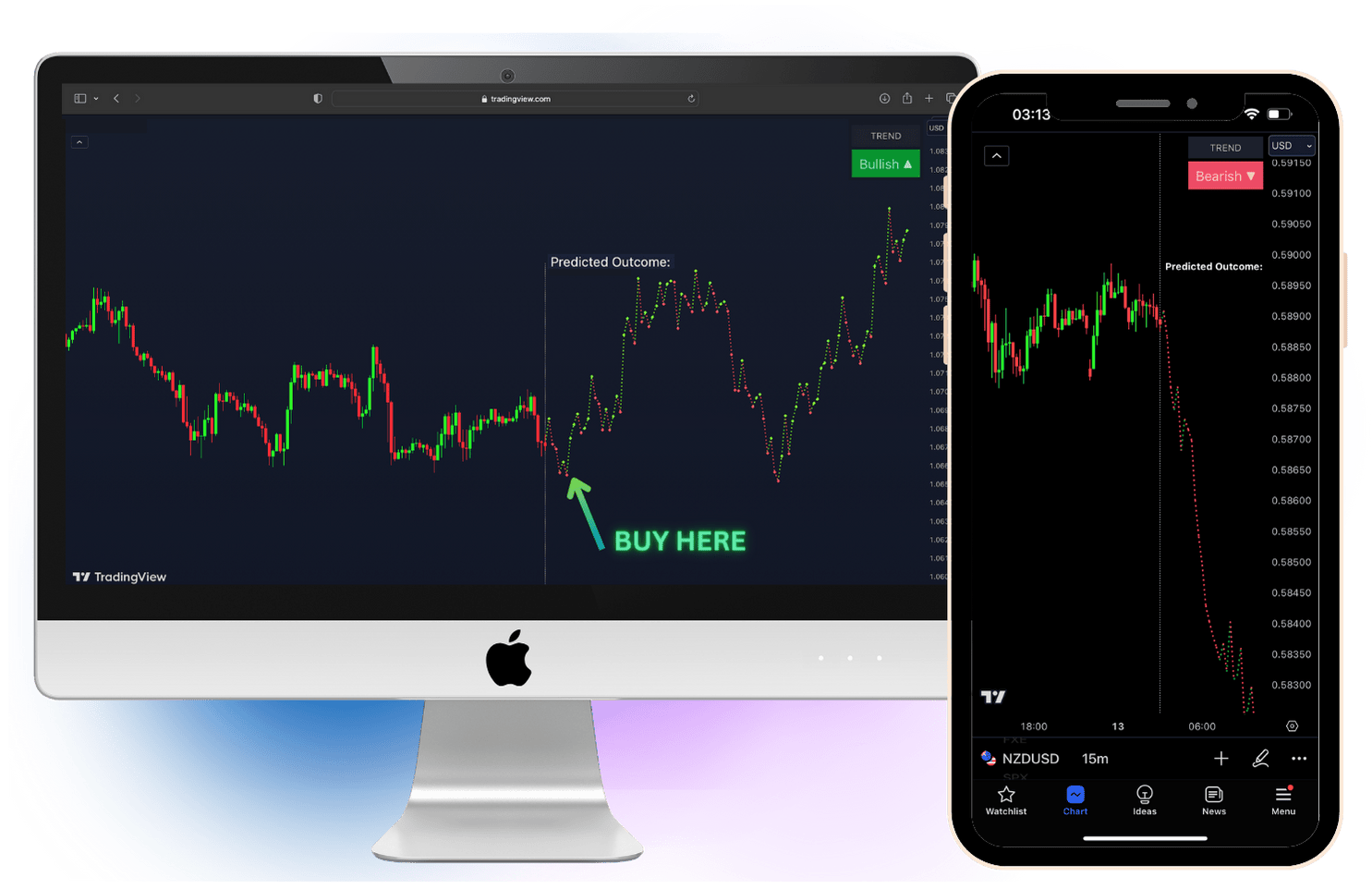

Demo Example Of The Indicator In Action

This is an example of the VIP indicator attached to USDJPY on the 1 hour time frame.

How To Use

1. Use the indicator on any market or time frame you like.

2. The indicator displays support levels in green and resistance levels in red. If the market is holding onto a green support level, it usually means there is will be potential rise in the market, indicating a good time to consider a buy. Conversely, if the market is holding onto a red resistance level, it hints at a possible market drop, signaling an opportune moment to sell. Also, if the market breaks a support level, it usually means the market will go down even more, whereas if the market breaks a resistance level, it usually means the market will continue to go upwards.

3. When the indicators moving average is green, this means the market is "BULLISH" and it is only best to take buying trades. When the indicators moving average is red, this means the market is "BEARISH" and it is only best to take selling trades.

4. In the top right corner, you can see that the support & resistance indicator features the current market trend. If it shows "BULLISH," it's best to focus on buy trades, aligning with upward market momentum. If it shows "BEARISH," consider sell trades, in line with downward market trends. For example, if you take a buying order, you can simply place your take profit at the next resistance level and your stop loss at the last support level. If you take a selling order, you can simply place your take profit at the next support level and your stop loss above the last resistance level.

5. Exit the trade when the trade hits your take profit target.

The time frame that we find the most profitable for this indicator are from between the 15 min time frame up to the hour 4 time frame.

The settings for the indicator are best left as default. We created the indicator in a very specific way which does not require you to change anything and rather leave it run in its most profitable potential.

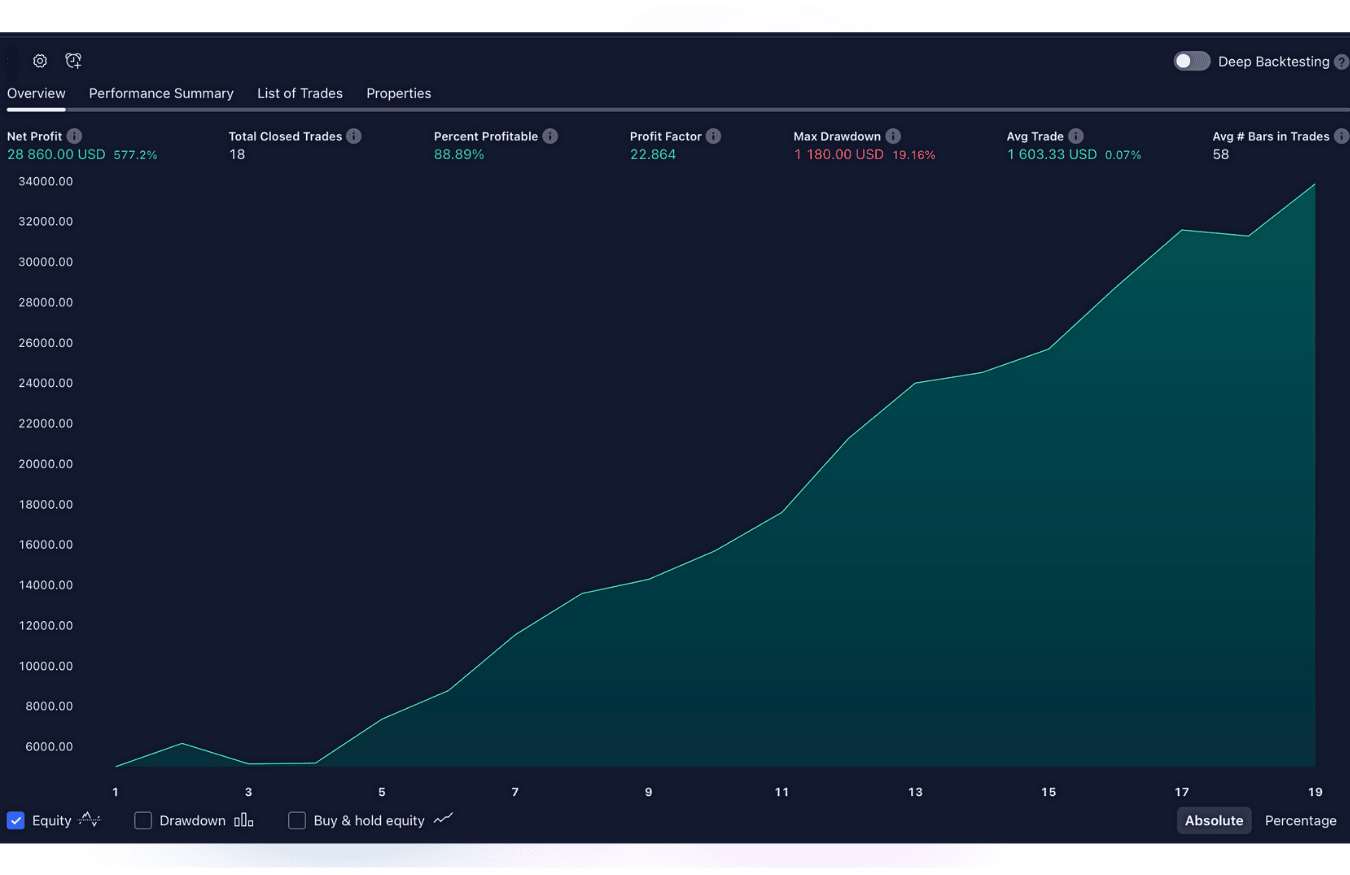

The VIP Trading Indicators Are Very Profitable

Live Trading Results :

VIP Indicators Win Rate: 93.2%

Number Of Trades Taken: 6498+

Number Of Winning Trades: 6063

Active Indicator Members: 126,503

Average Member Profit: $425/ Day

VIP Indicators Win Rate: 93.2%

Number Of Trades Taken: 6498+

Number Of Winning Trades: 6063

Active Indicator Members: 126,503

Average Member Profit: $425/ Day

VIP Indicators Can Make You Profit On A Daily Basis Up To 93% Of The Time

The VIP trading Indicators are designed to help you grow your trading account balance in the short and long term. The more you use our indicators, the more you can expect to grow your account.

FAQ

Below are some frequently asked questions:

How Can I Get Started?

You can simply get started right now by clicking HERE .. Once you have paid and purchased the deal, you'll get direct access to all the 5 profitable VIP indicators instantly. Once you have paid you will get redirected to the page which gives you access to everything. You will also get an email with the link to your products.

How Does It Work?

Once you have purchase the vip indicator deal, you will be able to get access to the indicators and add them to your charts on TradingView. Adding the indicators to your chart is very simple and we have tutorial videos for members on how to use the indicators and add them to your chart. Our indicators work on the Tradingview app which is a free trading chart platform for any device (You can create a free TradingView account HERE). Once you have added an indicator to your chart, you'll be able to use it in full detail as well as getting buy and sell alerts which will help you find the most profitable trades for the day. You will also be able to join our private telegram group with other members where you will see live alerts and profitable opportunities on a daily basis. If you have any issues you can contact us at [email protected]

Can A Complete Beginner Use Our VIP Indicators

Yes, 100%! All of our trading indicators are extremely easy and very simple to use. The indicators do all the complexed work for you and simply tell you where to buy, where to take profit and where to place your stop loss. We also offer new members free help / support with getting set up and creating an account to take your trades with and everything else. Even if you can't read the charts, our simple & powerful VIP Indicators will tell you when to buy and where to take profit, finding you profitable market opportunities 24/Hrs per day

What Markets Do Our Indicators Work With?

VIP Indicators work on any market available on TradingView. The Indicators also work on all timeframes including 1m, 5m, 30m, 1H, 4H, 1D, etc.

The Trading indicators that we provide can work for any style of trading, whether it is short term daily or long term trading, our indicators work for all types.

How Accurate Are The VIP Indicators?

On average, the VIP indicators can make profit up to 93% of the time. This is based on years of backtesting by our team and customers.

What Do You Get After Purchasing?

You'll receive all the 5 most profitable VIP trading indicators + You'll get to join the private telegram group.

Ready To Get 24/7 Access To Some Of The World's Most Profitable Trading Indicators?

VIP Indicators Are Designed To Make You Profits.

Get Access To 5+ Of The Most Powerful VIP Indicators

VIP Indicators Work For All Different Trading Markets & All Time Frames

VIP Trading Indicators Are Easy To Use And Find You The Best Trading Opportunities 24/hrs

You'll Get 24/7 Live Support From Our Expert Team With Getting Set Up + Tutorial Videos On How To Use Each Indicator

Weekly average profit for the VIP members:

: $2850+

Average profit made by taking an indicator signal:

: $390+

Using the VIP indicators can be one of the best ways for any type of trader to grow their account. Using VIP indicators is one of the fastest ways to grow!

VipIndicators.com - COPYRIGHT © 2024 - ALL RIGHTS RESERVED

We Do NOT offer any Investment advice or COPY TRADING services whatsoever. The indicators are used only for educational purposes.

By using our currency chart you acknowledge that we are not providing financial advice.

Charts used on this site are by TradingView in which our indicators are built on. TradingView® is a registered trademark of TradingView, Inc. www.TradingView.com. TradingView® does not have any affiliation with the owner, developer, or provider of the products or services on this site.

Trading involves high risk, and a majority of traders incur losses. The information and services provided by VipIndicators.com on this site are purely for educational and informational purposes. All content should be viewed as hypothetical and is presented post-event to illustrate our product. It should not be interpreted as advice. Decisions regarding buying, selling, holding, or trading carry risks. These decisions should ideally be made with guidance from qualified professionals. Remember, past success does not ensure future performance.

No claims are made that any account will, or is likely to, achieve profits or losses similar to those discussed.

Support and resistance trading indicator, The best support and resistance trading indicator

CUSTOM JAVASCRIPT / HTML